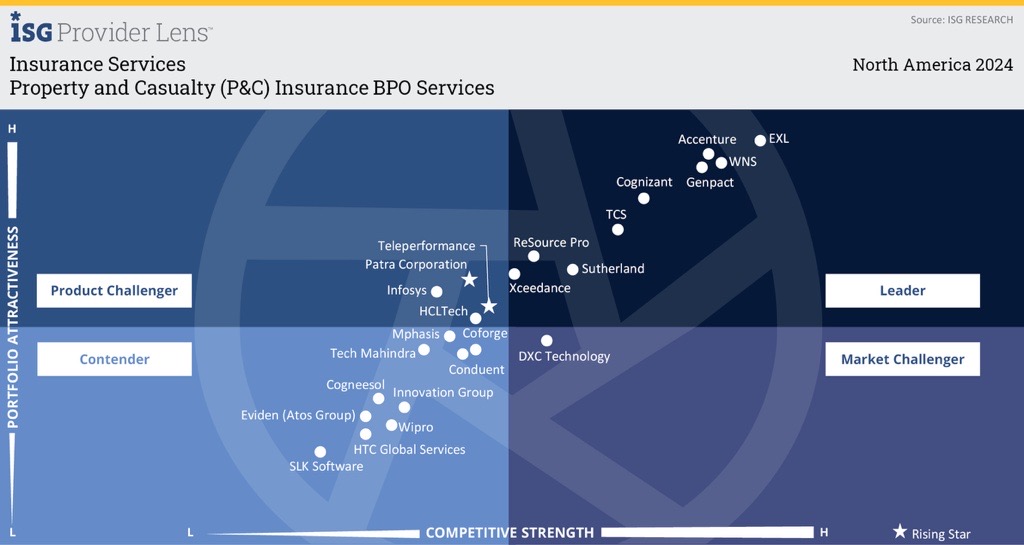

Xceedance Recognized as a ‘Leader’ in Insurance Services Report by ISG across North America

ISG has recognized Xceedance as a ‘Leader’ in its 2024 Insurance Services Report in North America for the Property and Casualty (P&C) Insurance BPO Services quadrant. This recognition underscores our strong market positioning, depth of services and offerings, and strong insurance focus.

This quadrant is relevant to North American enterprises evaluating P&C insurance BPO services. ISG assesses providers based on their service offerings and market presence.

The P&C insurance market faces challenges such as climate change, economic conditions, regulatory changes, and rising inflation, impacting consumer spending on insurance products. Low interest rates affect insurers’ investment returns, prompting pricing strategy adjustments. Technological advancements are needed to meet customer expectations for personalized and efficient services, and the demand for digital platforms for policy management and claims processing complicates operational efficiency.

To address these challenges, enterprises invest in technology and automation to streamline operations and enhance customer experience (CX). Collaboration with insurtech companies is common, allowing traditional insurers to leverage innovative solutions. P&C insurance BPO providers offer advanced technologies like AI, ML, and automation to improve claims processing, policy administration, and customer service while ensuring regulatory compliance. There is an increasing emphasis on data-driven decision-making and personalized CX through omnichannel platforms integrating AI-driven chatbots, mobile apps, and personalized communication.

BPO providers manage processes on clients’ behalf, enhancing them through digitalization and emerging technologies like intelligent automation, advanced analytics, GenAI, AI, and ML. Digitalized operations provide speed, cost, and accuracy benefits.

P&C outsourcing services include consulting, technology enablement, and managed services across areas like auto, theft, property, and natural catastrophes. Insurance firms focus on modernizing services and improving customer management and technology enablement to enhance CX across the P&C lifecycle.

As a 100 percent insurance-focused strategic operations support, technology, and data services company with more than 4,000 employees across nine global offices, Xceedance leverages its deep insurance domain expertise and capabilities across the entire insurance value chain. Xceedance excels in managing exposures, enhancing risk estimation, and offering specialized services, supported by certified professionals. The acquisition of Millennium Information Services, one of the largest property inspection and data analytics companies in the U.S., has strengthened our analytics capabilities, enhancing end-to-end underwriting support for insurers and MGAs. Our digital-first, AI-enhanced claims processing solutions and streamlined risk assessment and pricing workflows further demonstrate our commitment to driving innovation and operational efficiency in the insurance industry.

Read the full report here.